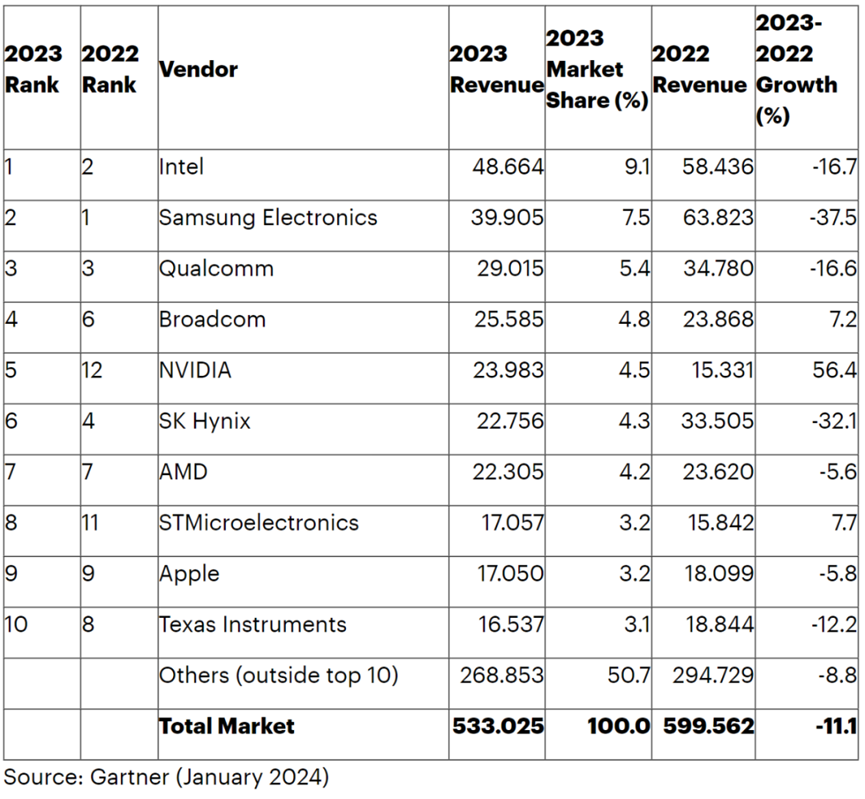

On January 16, 2024, the US market research company Gartner announced that global semiconductor sales (preliminary data) will drop 11.1% year-on-year to US$533 billion in 2023. By supplier, Intel’s sales surpassed Samsung Electronics (hereinafter referred to as “Samsung”) for the first time in three years.

The ranking of memory manufacturers has dropped sharply, and Micron has fallen out of the top 10.

According to Gartner, memory market revenue will decline 37% year-over-year in 2023, the largest decline among all segments of the semiconductor market. “2023 is going to be a tough year for the market, with memory sales recording their worst ever decline and a cyclical cycle in the semiconductor industry,” said Alan Priestley, vice president analyst at Gartner.

In terms of products, DRAM sales dropped 38.5% year-on-year to US$48.4 billion, and NAND flash memory sales dropped 37.5% year-on-year to US$36.2 billion.

Against this backdrop, only nine of the top 25 semiconductor suppliers achieved sales growth in 2023, while 10 recorded double-digit declines. In addition, the total semiconductor sales of the top 25 semiconductor manufacturers will decline by 14.1% year-on-year in 2023. This represents 74.4% of the total market, down from 77.2% in 2022.

Affected by the memory recession, the top 10 semiconductor manufacturers also experienced significant fluctuations. Memory giant Samsung seized the top spot from Intel in 2021 and maintained the top spot for two consecutive years. Its revenue dropped sharply to US$39.905 billion, a year-on-year decrease of 37.5%. Intel also experienced a 16.7% year-on-year negative growth, but its revenue was US$48.664 billion, surpassing Samsung and returning to the top of the market. As in the previous year, Qualcomm ranked third, down 16.6% to $29.015 billion.

SK Hynix, the major memory manufacturer that ranked fourth last year, also fell sharply, falling 32.1% year-on-year to sixth place. In addition, another memory giant, Micron Technology, which ranked fifth last year, fell sharply by 40.3% year-on-year to 12th place, disappearing from the top 10.

The picture shows the top 10 semiconductor manufacturers in global revenue in 2023 (unit: billion US dollars)

Nvidia has grown rapidly, rising from 12th to 5th place

Revenues in the semiconductor market (excluding memory) fell 3% year over year, according to Gartner. Additionally, demand for artificial intelligence (AI) applications is increasing, and automotive sectors such as electric vehicles (EVs) and the defense/aerospace industry are also seeing strong sales. Due to the rapid growth in demand for generative AI, NVIDIA performed well, achieving a rapid growth of 56.4% year-on-year, rising sharply from 12th place in the previous year to 5th place, entering the top 5 for the first time. Broadcom also rose 7.2% year-on-year, rising from sixth to fourth. STMicroelectronics grew 7.7% year-on-year, rising from 11th to 8th place, driven by strong performance in the automotive industry.

Looking at other changes in the top 10, Texas Instruments dropped from 8th to 10th last year, a drop of 12.2%. MediaTek, which was 10th last year, dropped 26.2% from the previous year, falling significantly outside the top 10. to No. 13. AMD and Apple maintained their seventh and ninth positions despite negative year-on-year growth of 5.6% and 5.8% respectively.